As supply chain disruptions related to the global pandemic have presented significant challenges for procurement teams across many industries, utilities have been better positioned than most. Just-in-time inventory was not a widely implemented strategy, so until now, utilities have avoided the worst as the global economy has conspired to bring supplies to market after-you-need-it. Grid resilience and recovery, along with commonplace regulatory frameworks, encouraged thoughtful, careful, and strategic procurement practices that evolved over time. As a result, utility procurement is characterized by steady but notable change that has led to a long-term sustainable model and historically provided insulation from supply chain snarls. However, it has recently become apparent that utilities are not immune from disruptions with shortages now commonplace in critical materials.

Tighter alliances balanced with managed diversification

Now faced with shortages, persistent inflation, and shipping bottlenecks, utility CPOs and procurement teams have been struggling to find the right balance between supplier alliances and sourcing diversity. Pre-pandemic, the pendulum had swung in favor of alliances. Procurement teams were enjoying the efficiencies of a sourcing strategy in which you commit to a supplier, and they give you a long-term commitment in return. There were clear advantages and efficiencies in a consolidated sourcing strategy that could leverage volume. Then, two and a half years ago, everything changed with the pandemic. Suddenly the value of diversification was seen in sharp relief, with organizations looking anywhere and everywhere to fill their needs.

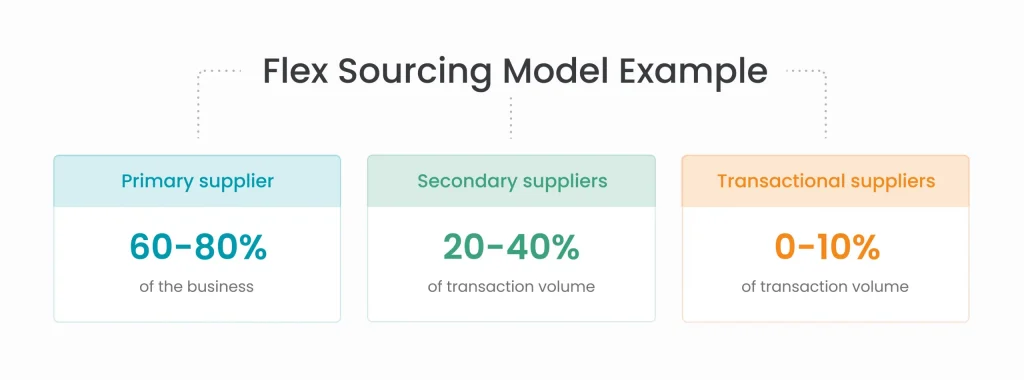

In the wake of the pandemic, we see our clients practicing more of a flex model (e.g., a 70/30 percentage mix) that retains alliance suppliers as a base while introducing additional suppliers in a backup position, while also utilizing the spot market to test pricing and secure ad-hoc, open production slots. A flex model does not discount the advantages of alliances, but rather creates a sourcing mix that adds resiliency and flexibility. When a port is closed or a supplier experiences raw material challenges, the procurement relationships exist to enable a seamless shift to alternative sources.

Supplier diversification and resiliency have become even more critical to our industry over the past few years of turmoil amongst the backdrop of global interdependence. Let’s explore an example of a successful flex model implemented to mitigate market and economic uncertainties.

-

Primary supplier

Your primary strategic supplier, with whom there is a high-level of mutual reliance and potential impact, makes up approximately 60-80% of your business. This is a supplier where both parties are committed to a strong, symbiotic partnership where executive alignment at the highest levels exists and is supported.

Your primary supplier engages with you on strategic endeavors including long-term purchasing commitments, potentially with joint R&D and product development investments, as well as with the collaborative creation of design alternatives (e.g., lighter weight and different pole mounts). You may also co-develop intellectual property commitments to enable your supplier to make capital investments and expand production capacity into new facilities. As a best practice, a utility company should establish SLAs with the supplier to commit to minimum on-time delivery rates and provide a legal option to end the agreement if those expectations are not met.

In today’s market of constrained materials, these alliance relationships have become even more critical. Some suppliers suffering manufacturing slowdowns due to shortages in labor and raw materials are electing not to participate in RFPs or renegotiations. Other suppliers are only working with their alliance partners.

-

Secondary suppliers

Back-up suppliers comprise 20-40% of your transaction volume. These partners allow you to be flexible with your fluctuating volume needs by providing excess capacity as needed with the security of supplier diversification.

-

Transactional suppliers

Your remaining suppliers will provide your business with up to 10% of transaction volume by offering both access to spot buys to take advantage of excess market capacity and constant monitoring of the spot market. If there is any disruption with these transactional suppliers, there will be little to no interruption in your supply chain ecosystem.

Utilities’ unique positioning and opportunities

In many ways, supply chain issues play out differently in the utility industry compared to other parts of the economy; consider historical mutual assistance calls that share crews and equipment during emergencies. A utility company that has come through a natural disaster might be able to borrow scarce distribution transformers or other materials from a neighboring utility. This is in sharp contrast to what happened in healthcare during the pandemic, when companies closely guarded supplies of personal protective equipment.

Faced with persistent supply chain concerns, procurement has risen in importance and often has the attention of the CEO and even the Board. Today’s opportunity allows the creativity and innovation of supply chain teams to come to the fore and offers a chance to make an impact in every part of the organization.